how much does a property tax lawyer cost

This shows tax lawyers cost a fortune. Trial Cases Can Run 5000-15000.

For simple cases that require only a modest amount of.

. Check now to get Free Attorneys and Legal Guidance. Based on ContractsCounsels marketplace data the average cost of a lawyer in any legal field is 250 - 350. The attorneys length.

Typical Cost of Hiring a Tax Attorney Heres a very simple breakdown of the average prices that tax attorneys charge for common tax services whether hourly or as a flat fee. Due to the unpredictable nature of litigation it is difficult to accurately estimate the total cost of a case in advance. How Much Does a Tax Attorney Cost.

Get Free Attorneys and Legal Guidance Immediately. Nov 6 2019 On average a tax attorney costs about 300 per hour with average tax lawyer fees ranging from 200 to 400 in the US for 2019. Ad Find a Lawyer Online Now - Free.

Some taxpayers may have the opportunity to negotiate a flat fee for legal representation against the IRS. Taxes are a part of almost every activity in everyday life businesses and every individuals yearly requirement to pay income taxes. Some lawyers bill by the hour for their work while others quote a flat fee rate contingency rate or use retainer fees.

The value of a tax lawyer is almost immeasurable. Attorney Cost for Real Estate Litigation. Lawyers work with different types of billing structures which can also affect the overall price of their services.

You might also expect that lawyers charge higher rates as they gain more experience. Highly experienced attorneys or attorneys working in big firms in large cities can charge more than 1000 per hour. Post Your Job Receive Competitive Prices From Tax Lawyers In Minutes.

The limit for this annual. Some of the most respected and experienced attorneys may set hourly rates at 1000 per hour or more. Again tax attorneys earn an average salary of 101898 making this a lucrative career option.

Free Confidential Lawyer Locator. Some attorneys charge set fees for certain tax services and others charge an hourly rate charging the client a retainer based on that rate to start. A tax lawyer gives advice to the clients on how to tackle difficult tax laws and possibly save up a hefty amount of money by taking some benefit of the acceptable.

For example most tax attorneys have a bill of 200 to 400 per hour. Every attorney will charge a different hourly rate but most rates are between 200 to 400 per hour. The complexity of your case can determine the rates.

The average cost for a Tax Attorney is 250. As an example of the different rates you can pay consider the following estimates. A tax lawyer is someone who has received training in tax law.

Some attorneys charge set fees for certain tax services and others charge an hourly rate charging the client a retainer based. Hourly fees for tax attorneys range from under 200 to over 450 per hour depending on a firms reputation a lawyers experience and other factors such as. But when youre comparing lawyers and their fees.

What is average cost for a tax attorney. Your geographical location may also affect how much your. Some attorneys charge set fees for certain tax services and others charge an hourly rate charging the client a retainer based on that rate to start.

Attorney fees for real estate litigation generally range from 150 to 400 per hour. Our study bore out that expectation with average minimum and maximum rates climbing from 235 and 305 for tax attorneys with 10 years or less in practice to 365 and 460 for those with the most experience. Also known as a tax attorney a tax lawyer has a lot of knowledge in the complex and ever changing field of taxes.

Hourly fees for tax attorneys range from under 200 to over 450 per hour depending on a firms reputation a lawyers experience and other factors. For many other sorts of cases particularly tax issues an hourly fee is a typical approach to charge. Ad You Dont Have to Do It Yourself Spend More Time on What You Do Best Get More Done.

Due to these variations it is crucial to have an upfront. How Much Does a Tax Lawyer Cost. To negotiate small agreements with the IRS you can pay from 700 to 1500.

Hourly rate or retainer. Jun 22 2021 An hourly rate is a common way to bill for many types of cases including tax cases. A lawyer often charges between 100 and 400 per hour for their services.

In general legal work isnt cheap. A tax attorney provides legal advice to individuals businesses and organizations about income estate gift excise property and other local state federal and foreign taxes. According to a survey by Martindale-Avvo a legal marketing and directories firm tax attorneys charge 295 to 390 per hour on average.

Ad Top Pro Bono lawyers in your place. That said sometimes a real estate attorney is in the best position to evaluate tax consequences. A gift tax applies to cash or property gifts that an individual can give away annually.

Tax lawyers charge a minimum of 295 per hour and a maximum of 390. Notably some lawyers charge far more than this average often up to 1000 per hour. The average hourly cost for the services of a lawyer 12.

Every tax attorney has a different rate but expect it to range from 200 to 400 per hour. Save Time - Describe Your Case Now.

Saranow Premier Chicago Property Tax Attorney Lawyer Firm

Should You Be Charging Sales Tax On Your Online Store Sales Tax Tax Filing Taxes

Tax Tips For The End Of The Year Tax Debt Property Tax Tax Lawyer

Growing Out Of Control Property Taxes Put Increasing Burden On Illinois Taxpayers Property Tax Tax Illinois

Ranking Unemployment Insurance Taxes On The 2019 State Business Tax Climate Index Legal Marketing Local Marketing Business Tax

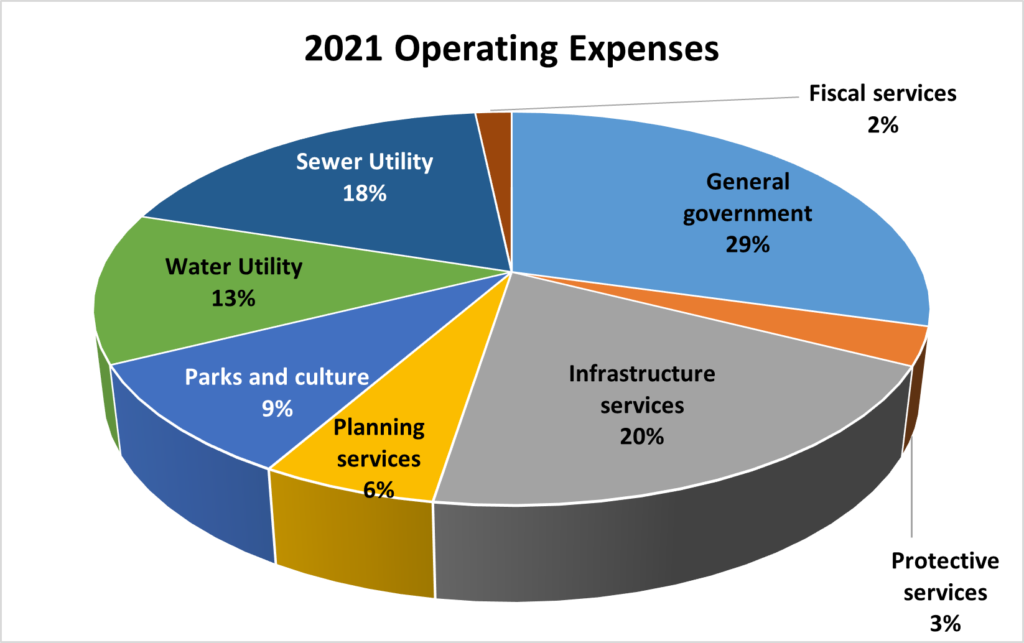

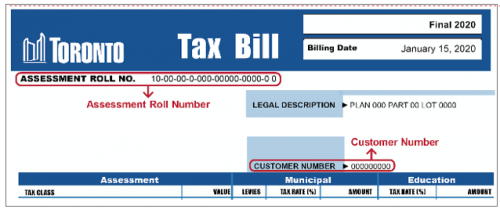

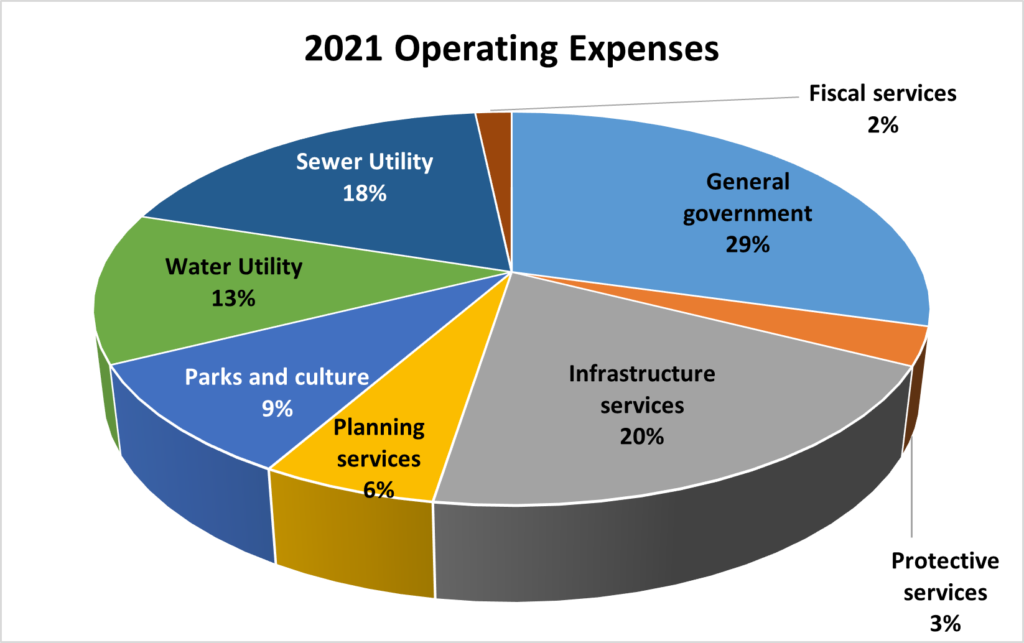

Tax And Utilities Answers City Of Toronto

Cypress Texas Property Taxes What You Need To Know

Claiming Expenses On Rental Properties 2022 Turbotax Canada Tips

Marketing Solutions On Twitter Real Estate Auction Foreclosures Tax Lawyer

Consult Top Property Tax Expert Lawyer In India Tax Lawyer Property Tax Legal Advice

Pin On Integrated Professional Services Organization

Chicago Property Tax Lawyer Brings A Unique Approach To The Legal Industry By Providing Our Clients With Except Tax Preparation Filing Taxes Tax Deductions

Property Taxes Town Of Gibsons

Find The Best Wills And Estate Planning Lawyer In Ca

There A Lot Of Taxes You Are Paying If You Have A House You Are Paying Property Taxes For That For Business You Are P Tax Attorney Tax Lawyer Online Taxes